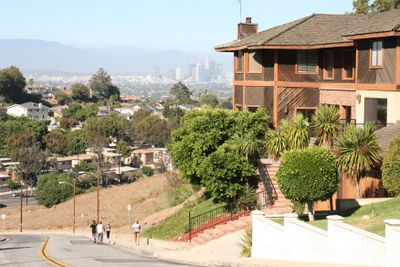

Photo credit: Spot Us

Low-income homebuyers may not benefit from programs as previously thought.

From its founding, United States leaders have encouraged homeownership for all; with Thomas Jefferson extolling the virtues of a democracy powered by small landowning citizenry. In time, the American Dream eventually became synonymous with the standard issue modest home with a property-defining white picket fence. Would Thomas Jefferson and other bygone-era leaders recognize the American Dream today?

Homeownership has been the great equalizer, especially in times where financial inequality have steadily increased. This drives the wisdom of emphasizing homeownership. Homeownership encourages many positive things such as neighborhood stability, community growth through property taxes, for many the largest source of wealth passed from generation to generation and for lower-income homeowners, a type of forced savings program while paying down a mortgage.

See Minorities and Housing in 2015

See Minorities and Mortgage Approvals

See Buying a Home is Half the Cost of Renting

The last great housing boom pushed the “homeownership is good” mantra to the limit when nearly 70 percent of Americans owned a home. Many homeowners utilized programs powered by policies to quell increasing financial inequality and encourage homeownership. The bubble burst and soon homeownership levels dropped close to levels not seen since the late 50’s.

Local, state and federal housing programs, while well-meaning overall, often results in an outcome opposite to that which is intended. In one example, in an affordable housing program, in exchange for very favorable public-financing, low-income borrowers must agree to equity amount restrictions when the property is sold. Although the intended effect is for preserving the initial subsidy, usually the end result is homeowner income mobility is restricted by not having enough net proceeds to purchase in the unsubsidized market.

Buying a home is a gamble. Low-income homeowners often don’t have much flexibility when life happens such as the loss of a job or when there are mounting medical bills. Although the mortgage is usually one of the last monthly expenses affected by life’s aberrations, getting behind on the mortgage underscores the gamble in buying a home as there’s no guarantee that you’ll want to or can remain living in one place.

When negative equity is added to this dynamic, low-income homeowners’ already delicate financial security takes a bigger hit. Less-affluent neighborhoods tend to have higher concentrations of negative equity, low valuations, lower returns and higher price volatility and homebuyers in these neighborhoods frequently are assisted by local, state and federal programs that encourage them to make less than beneficial investments.

See Is Housing Counseling as Effective as it Should Be?

Overall, homeownership has been a boost to millions, but in some cases, it hasn’t delivered as touted. Homeownership is obviously not for everyone, but we continue to hammer the one size fits all mantra that it’s the best option between renting and buying. We may worry less about the one-third of Americans that rent and local, state and federal housing policy may not emphasize addressing the crisis in affordable rental housing.

Lower-income Americans should have access to homeownership opportunities and aspire to home buying, however realities need to be addressed, which could be a catalyst for creating wider housing options and solutions which address the realities faced.

See Will Homes Become Less Affordable in Three Years?

See New Mortgage May Increase Home-Ownership Rate

We are living in a period of unparalleled technological advancement, flexibility and creativity; the housing industry could do different things. Innovative ways to wealth-building could be explored outside the typical homeownership paradigm. With the abundance of single-family rentals in the aftermath of the housing crisis, we could explore the feasibility of expanding renting-to-own on a larger scale. The main sources of inequality which drives differences in homeownership could be analyzed and focused on. Although the second idea dives into the tangible and theoretical, it will involve taking a hard look at ourselves and our willingness to resolve and thus be the catalyst to rebuilding and solidifying the American Dream.

Thomas Jefferson would be proud.

Resources:

Georgetown University Law Center. The Meaning and Nature of Property: Homeownership and Shared Equity in the Context of Poverty

USA Today. An inconvenient truth about homeownership: Column