Photo Credit: Steven Depolo

The big debate in housing and financial industry circles in the post-housing crisis world has centered on whether to rent or buy, triggering endless lists of pros and cons of both. In recent years, renting nearly became the default housing arrangement among many demographics, with millennials leading the way due to tighter credit and an anemic job market which made it more difficult making down-payments.

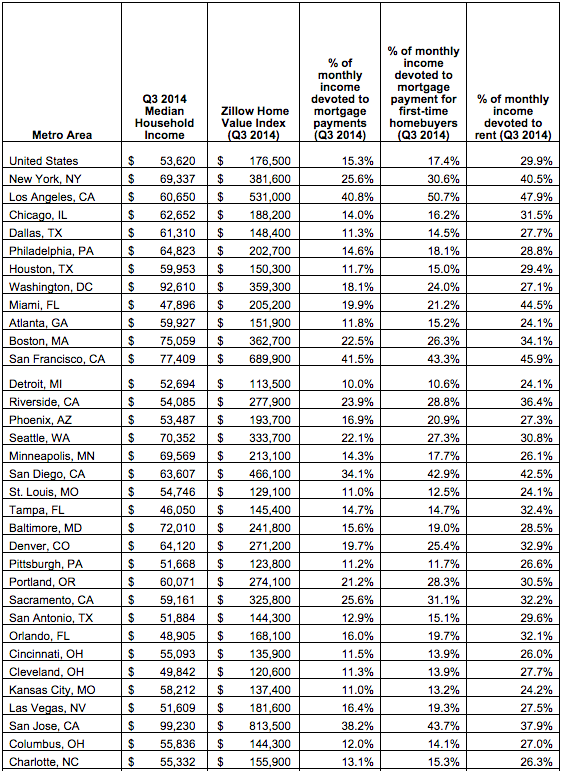

According to a Zillow analysis of third quarter income and home value data, it’s now more affordable to buy a home in most U.S. metros than it was 15 years ago. Even with millennials putting down less money, affordability is still not affected.

Renters continue to pay an increasing percentage of their income to their landlords as rent increase and incomes remain stagnant.

See Rental Affordability – A Hushed American Crisis

The average homeowner on a median income living in a typical home, spends 15.3 percent of their income on their monthly mortgage payment, this is down from the historical norm of 22.1 percent during the pre-bubble period from 1985 to 1999. Renters however, spent 29.9 percent of their monthly income on rent in the third quarter of 2014, which rose from the historical norm of 24.9 percent.

Millennial buyers who earn less money in many areas and are making smaller down-payments, will spend an average of 17.4 percent of their income on mortgage payments. Younger buyers’ homes remain affordable thanks to continued low mortgage interest rates and because of their focus on shopping for less expensive homes.

Steady rent increases across the country could push more people into the home-buying market, but the downside is this higher rent makes it difficult for first-time buyers to save for a down-payment. For example, renters in Washington, D.C. can expect to spend 27.1 percent of their income on rent, this is up from the historical 16.2 percent. The increase in the percentage of income towards rent is more pronounced in Miami, currently at 44.5 percent compared to a pre-bubble average of 26.5 percent. Other metro areas with large differences between current and historic rent affordability includes Los Angeles, New York, San Francisco and San Jose.

Zillow Chief Economist, Stan Humphries said, “Despite rising home values, homeownership remains very accessible for buyers that can scrape together a down payment – even if that down payment is relatively modest – find a home to buy and secure financing. But what keeps me up at night is the fact that it still remains so difficult for so many potential buyers to make those particular stars align, largely because renting is so unaffordable these days. It’s very difficult to come up with a down payment when so much of your monthly paycheck – especially on an entry-level salary – is going to your landlord instead of into your savings. Buying conditions are getting better every day, and in time the allure of fixed housing payments and building wealth through home equity will draw more buyers out of rentals and into homeownership.”

List of metro areas by percentage of monthly income devoted to mortgage payments, mortgage payments by first-time home-buyers and rental payments

Source: Zillow

Resources:

HousingWire: Zillow: Renting is twice as expensive as buying

Zillow.com. ‘What’s Up? Nothin’ But the Rent.’ Rental Affordability Continues to Suffer in Q3