Small increases in interest rate can make half of metros unaffordable

Housing affordability is the real economic challenge facing the U.S. according to the latest outlook report by Deutsche Bank (DB). The ability for an American with a median-income to be able to purchase a home is slipping quickly. Chances are not expected to improve because interest rates are expected to rise next year.

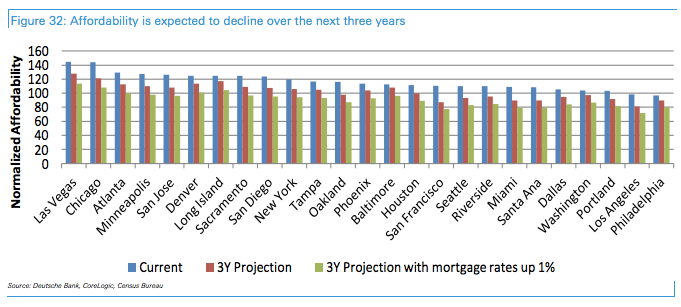

The report’s analysts estimates that half of the 25 largest U.S. housing markets will become unaffordable to the median-income earning family with all things being equal. Interest rates are expected to rise more than 2 percent and while this may take around three years to manifest, by this time all markets could be unaffordable.

“If rates also rise by 1% then the normalized affordability index falls below 100 for 21 of the top 25 markets,” report research analysts Richard Mele and Ying Shen.

Having an affordability index of 100 means that a family with a median income makes exactly enough to qualify for a mortgage on a median-priced home. An index score above 100 means that a family earning a median income, with a 20 percent down-payment, has more than enough income to qualify for a mortgage on a medium-priced home.

Predicting affordability

In the above graph, a 1 percent increase in the index equals a mortgage payment rising 12.5 percent for those earning $53,000 per year. This places most mortgages below 100 in affordability. With interest rates above 5 percent a few years ago, this doesn’t come as a surprise. While this data may suggest that renting may become more favorable in these markets, there are analytics which may offer a different view.

See Adjustable Mortgage Rates May Be Better for the Economy

See New Mortgage May Increase Home-Ownership Rate

Price appreciation continues to slow, unemployment is much lower than in 2009, Fannie Mae and Freddie Mac will start backing 3 percent down loans and mortgage-lending standards are expected to loosen next year. The analysts posits that in order for the housing market to become more balanced and thus healthier, mortgage interest rates need to stay put and incomes need to increase; or at the least stay where they are. The analysts predict the chance of incomes remaining the same or increasing is higher than mortgage rates NOT rising.

The average American with a median income may have only 3 years to buy a home before they become unaffordable.

Resource:

HousingWire. Only 3 years left for the average American to buy a home