By Tali Wee of Zillow

Minorities across the country are still disproportionately denied conventional loans, drawing attention to the continued inequities in access to credit. Previously, PEMCO Limited detailed some of the causes for this disparity including minorities’ high debt-to-income ratios, low credit scores and human bias in underwriting. Updated results draw further attention to minorities’ lower household income compared to whites.

Median household income by race: Whites, $58,000; Hispanics, $42,000; and Blacks $35,000.

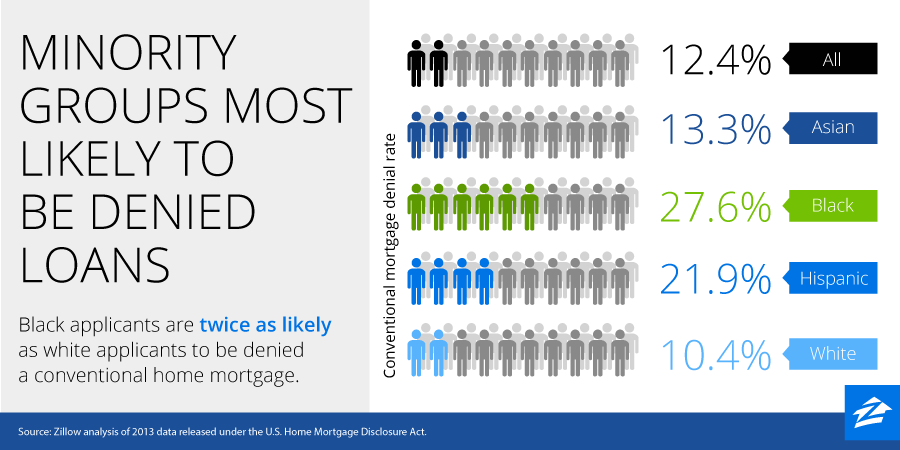

Conventional loans are denied at higher rates to ethnic groups with lower household incomes, according to Zillow. Black applicants were denied twice as often as whites.

Conventional loan denial by race: Blacks, 27.6 percent; Hispanics, 21.9 percent; and Whites, 10.4 percent.

Investors considering flipping properties in predominantly minority communities should recognize the challenges future buyers may face when attempting to fund home purchases for such properties, assuming buyers are of similar ethnicity to the property’s neighborhood.

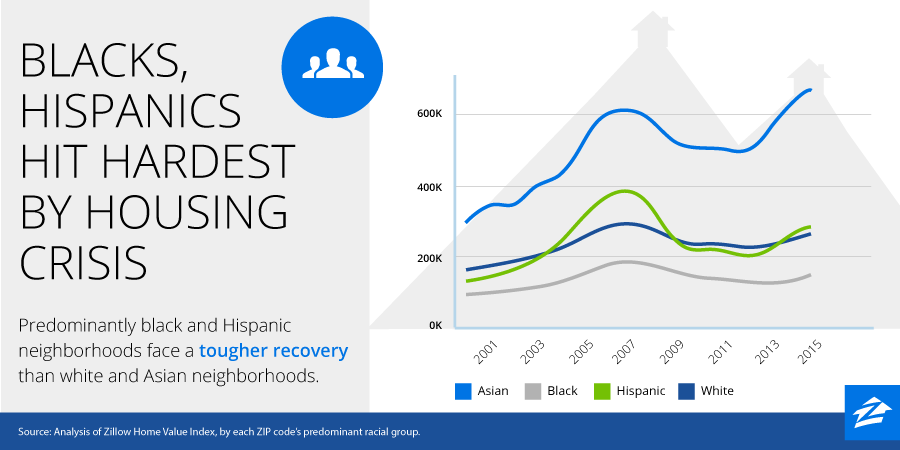

In addition to buyers’ disproportionate access to credit, Zillow data indicates home values in minority communities suffered significantly worse during the housing crisis than home values in white areas. Although home values declined across all races, investors who owned properties in black and Hispanic communities experienced the most dramatic depreciation.

Total home value depreciation from peak prices in 2007 to 2012 lows: Hispanics, 46.3 percent decline; Blacks, 32.1 percent decline; and Whites, 23.6 percent decline.

Home values in minority areas have not recovered as well as home values in white areas, but all are recovering. Hispanic communities’ home values fell the farthest from the top of the market and still have the farthest to climb back to peak values. Owners of properties in such communities are likely underwater. Alternatively, investors looking at the same data can pinpoint Hispanic areas as low-cost markets with room for appreciation and profit.

Home value recovery, distance below 2007 peak prices: Hispanics, 24.2 percent; blacks, 17.9 percent; and whites, 8.2 percent.

Still, the cause for such varied declines and recoveries across ethnic groups reflects deep-rooted economic disparities, resulting in lower household incomes for minorities, leading to less favorable loan terms and increased loan denial.

Investors in minority areas are susceptible to future economic shocks, like the Great Recession, leading to extreme home value depreciation. Perhaps the greatest takeaway for investors is to purchase and lease long-term, affordable rentals in economically vulnerable, minority communities. If ethnic disparities continue, minority buyers in minority neighborhoods will face further loan denials and risky short-term investments since home values spike and plummet dramatically. Residents with the inability to buy and underwater homeowners who default to foreclosures become renters. Investors who buy now, while prices are still low, may have better opportunities for resale returns upon full market recovery.

Resources:

Housing Market Performance by Racial/Ethnicity Communities: http://www.zillow.com/research/homeownership-by-race-2-8878/

U.S. Conventional Loan Denial Rates: http://zillow.mediaroom.com/index.php?s=28775&item=137134

Market Trends: http://www.zillow.com/blog/home-values-black-hispanic-areas-169344/

Bio: Tali Wee writes about finances, home improvement and interior design for Zillow and other partners.