Photo credit: Mick Baker

Is this much ado about nothing?

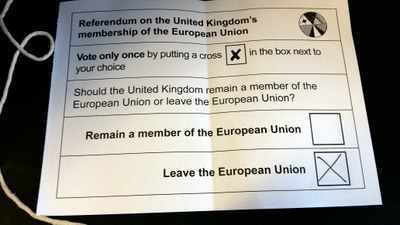

In a few years, Britain will officially leave the European Union after 25 years. While financial markets were shaken and the economic growth outlook was lowered in the days after the vote, there’s been much speculation on what effect Brexit will have on Britain, the U.S. and the world in the long-term.

One possible long-term effect in the U.S. may likely be an influx of investors in the real estate market.

National Association of REALTORs Chief Economist Lawrence Yun says, “Demand for U.S. real estate could rise.”

The effect on mortgage interest rates

Typically, when Treasury rates fall, mortgage rates fall and loans become less expensive. After Brexit won, investors pulled out of the U.K. and elsewhere and into the safer U.S. markets. This big jump in the number of investors in the U.S. real estate market could push up the dollar while putting downward pressure on long-term mortgage rates.

Mike Fratantoni, Chief Economist at the Mortgage Bankers Association said, “It is unclear whether this will just be a short-term disruption or whether it will have a longer-term impact. Our best guess at this point is that the impact on the mortgage market will be to keep rates lower for longer.”

Fratantoni’s assessment is underlined by Fannie Mae Chief Economist Doug Duncan, saying economic uncertainty could keep mortgage rates low for a while.

“The Fed will very likely be on hold for some time as it observes the impact on U.S. and global financial markets and economic activity,” he says.

The prospect of already historically low mortgage rates dropping lower in the near future, could help drive up U.S. real estate sales of all types.

Yun says U.K. citizens could pull back on their U.S. investments and vacation homes, “The British economy will be disrupted, and hence we should expect fewer Brits able to buy in the U.S.”

The effect on home prices

Buyers with money in the stock market who saw their investments decline in the aftermath of the Brexit vote, might become more cautious, this hesitation could cause a slowdown in price growth in the near-term, but as the cost of mortgages get cheaper, this should give these buyers more incentive to purchase.

Nela Richardson, Chief Economist at Redfin said, “We don’t expect a price surge and we might see dips in some markets. What happens next is about consumers and their ability to process uncertainty. Are buyers going to be less likely to bid up a house by $100,000? The fear factor might keep people from making their best offer.”

Sources:

Forbes. Brexit Hits Home: Five Questions for The U.S. Housing Market

NAR, REALTOR Mag. ‘Brexit’ Could Give U.S. Real Estate Brief Boost