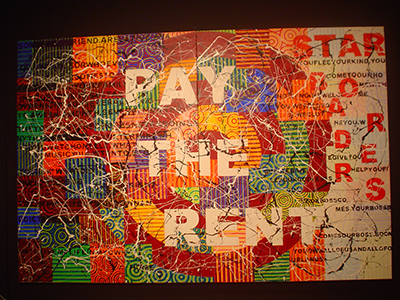

Photo credit: Duane_Brown cc

Wall Street’s $20 Billion Takeover is Raising the Rent

More than $20 billion have been invested in single-family homes since 2012 by Private Equity firms, according to a recent report by national housing activist group, Right to the City Alliance. The report is critical of the increase in REO-to rental and single-family rentals, saying the explosion of such properties have “proven disastrous for many low-income communities – with rents skyrocketing and corporate absentee landlords proliferating in urban areas across America.” $20 billion buys a lot of single-family homes for rental property conversion and this directly affects the availability of affordable homes for sale.

See The Rise in Single Family Rental Investing

See Housing for Sale but Not for First Time Home-buyers

“While cash sales are down from their July 2011 high of 42.8%, they are still very high (at 38.4%) compared to the 2001-2007 average of 25%,” said Mark Fleming, chief economist for CoreLogic. “Investors in general, whether institutional or ‘mom and pop,’ are primarily concentrated on two types of assets: distressed (real estate owned and short sales) and existing homes, rather than new builds.”

Rachel LaForest, executive director of Right to the City says, “The transformation of single-family rental housing from a ‘mom and pop’ industry to a global investment opportunity needs to be closely studied and regulated.”

Private Equity firms have bought mostly foreclosed homes in low-income neighborhoods, raising security deposits and rents to very high amounts while some families deal with absentee corporate landlords that in some cases have little incentive to make repairs, discuss rent issues or take care of pest problems.

U.S. Rep. Mark Takano, D-California, a longtime REO-to-rental critic says of the report, “Rental costs are getting further and further out of reach for working families. Wall Street’s purchasing of hundreds of thousands of foreclosed homes for the purpose of converting the properties into rentals and securitizing them into bonds, is troubling and must be closely monitored by the federal government.”

A few selected recommendations from the report:

Resources:

Housing Wire. “Is the investor rush on single-family homes the next housing bubble?” 21 July 2014. http://www.housingwire.com/articles/30693-is-the-investor-rush-on-single-family-homes-the-next-housing-bubble

Homes for All. Report: “The Rise of the Corporate Landlord” 21 July 2014. http://homesforall.org/campaign/wp-content/uploads/2014/07/corp-landlord-report-web.pdf