By guest writer, Jennifer Riner of Zillow

Although mortgage rates are almost at historical lows, not all borrowers attain approval when applying for conventional loans – with some groups struggling more than others. In early 2015, Zillow research revealed minority applicants were especially likely to encounter difficulty acquiring loans for homeownership, with denial twice as probable for black households compared to white households.

Only 3 percent of black homeowners – who make up 12 percent of the total U.S. population – applied for home loans in 2014, and only 2.5 percent of those applicants were approved. For comparison, 69.5 percent of white homeowners – who make up 62 percent of the total U.S. population – applied for mortgages, and 72 percent were approved.

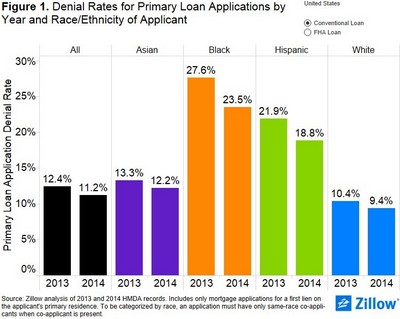

Although the percentages for minorities in 2014 were seemingly low, they represented a shift in denials from 2013. In fact, 23.5 percent of black applicants were denied conventional loans in 2014, down from 28 percent in 2013. And while 22 percent of Hispanic borrowers were rejected conventional home loans in 2013, 19 percent were denied in 2014.

The primary reason behind the decrease in denials between 2013 and 2014 is a shift toward more lenient lending policies. However, not all lenders are created equally. Home loan denial rates tend to fluctuate amongst minority groups depending on geographical location as well. Check out the best metros for both black and Hispanic borrowers across the country, and the home value specifics in those cities to determine potential affordability.

Blacks

Salt Lake City

For blacks in Salt Lake City seeking a mortgage, the denial rate is 9.1 percent, the lowest in the nation. The median list price is currently at $295,000. Using a mortgage calculator, you can assume a borrower puts $59,000 down, or the recommended 20 percent of the total median list price. At an interest rate of 3.807 percent, a Salt Lake City home buyer would owe $1,462 in mortgage payments each month – with $1,101 going toward P&I (principal and interest), $295 allocated toward taxes and $67 for insurance.

Hispanics

Pittsburgh

Hispanics have the best luck borrowing in Pittsburgh, where the denial rate is 8.3 percent. House hunters in Pittsburgh benefit from increasing home values – a positive outlook for future equity building. In fact, homes in Pittsburgh – which have a Zillow Home Value Index of $105,600 – have increased 4.5 percent in the past year and are expected to increase another 2.7 percent in the next year. Using the current median sale price of $145,250, assume a borrower in Pittsburgh provides $29,050 upfront. At an interest rate of 3.807 percent, the monthly payment would come out to be $754 per month – $542 in P&I, $145 in taxes and $67 in insurance.

Overall, the denial rate for all conventional mortgage applicants fell from 12.4 percent to 11.2 percent between 2013 and 2014, with the greatest strides occurring amongst minority groups struggling to access home loans. Regardless, just 41.2 percent of blacks and 45 percent of Hispanic households own their own homes, respectively, compared with a 57.5 percent rate for Asians and 71 percent rate for whites.